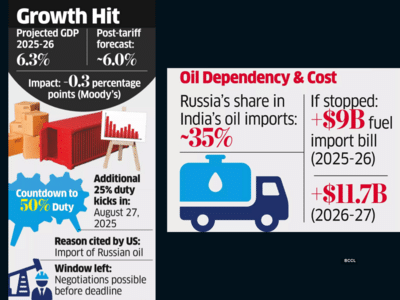

The 50% tariff on Indian goods announced by the US could reduce India's economic growth by about 0.3 percentage points, bringing it down from the projected 6.3% for 2025-26, Moody's Ratings said on Friday. However, it added that strong domestic demand and a resilient services sector would help cushion the impact.

"Beyond 2025, the much wider tariff gap compared with other Asia-Pacific countries would severely curtail India's ambitions to develop its manufacturing sector, particularly in higher value-added sectors such as electronics, and may even reverse some of the gains made in recent years in attracting related investments," said the New York-headquartered credit rating agency.

On Wednesday, US President Donald Trump announced an additional 25% tariff on Indian goods, as penalty for importing oil from Russia, raising the total tariff to 50%. The 25% additional tariff will kick in on August 27.

The time in between offers an opportunity for negotiations between the two countries.

Moody's Ratings said India's response to the developments will play a key role in shaping its economic outlook, inflation and external position.

In contrast, other Asian countries face significantly lower tariffs- Japan (15%), Thailand (19%) and Vietnam and Bangladesh (20% each).

The additional 25% tariff increases the "potential strain because it widens the gap compared with the 15-20% tariff rates for other countries in Asia-Pacific", said Moody's Ratings.

In a separate report, State Bank of India (SBI) said that if India halts Russian oil imports for the rest of this financial year, its fuel import bill could increase by $9 billion in 2025-26 and $11.7 billion in 2026-27.

Russia accounts for about 35% of India's oil imports. However, India has diversified its sources of supply to about 40 countries, with more supply coming onto the market from Guyana, Brazil and Canada, SBI said.

Sectors such as pharmaceuticals and electronics are currently exempted from the US tariffs.

"A possible tariff of 50% on pharma exports may hit earnings of pharma companies by 5-10% in FY26, as many big pharma companies' revenue from the US stood in the range of 40-50%," said the SBI report.

But the US will also suffer, according to SBI, as India plays a crucial role in the global supply of affordable, high-quality essential medicines, particularly life-saving oncology drugs, antibiotics and chronic diseases treatments.

"Beyond 2025, the much wider tariff gap compared with other Asia-Pacific countries would severely curtail India's ambitions to develop its manufacturing sector, particularly in higher value-added sectors such as electronics, and may even reverse some of the gains made in recent years in attracting related investments," said the New York-headquartered credit rating agency.

On Wednesday, US President Donald Trump announced an additional 25% tariff on Indian goods, as penalty for importing oil from Russia, raising the total tariff to 50%. The 25% additional tariff will kick in on August 27.

The time in between offers an opportunity for negotiations between the two countries.

Moody's Ratings said India's response to the developments will play a key role in shaping its economic outlook, inflation and external position.

In contrast, other Asian countries face significantly lower tariffs- Japan (15%), Thailand (19%) and Vietnam and Bangladesh (20% each).

The additional 25% tariff increases the "potential strain because it widens the gap compared with the 15-20% tariff rates for other countries in Asia-Pacific", said Moody's Ratings.

In a separate report, State Bank of India (SBI) said that if India halts Russian oil imports for the rest of this financial year, its fuel import bill could increase by $9 billion in 2025-26 and $11.7 billion in 2026-27.

Russia accounts for about 35% of India's oil imports. However, India has diversified its sources of supply to about 40 countries, with more supply coming onto the market from Guyana, Brazil and Canada, SBI said.

Sectors such as pharmaceuticals and electronics are currently exempted from the US tariffs.

"A possible tariff of 50% on pharma exports may hit earnings of pharma companies by 5-10% in FY26, as many big pharma companies' revenue from the US stood in the range of 40-50%," said the SBI report.

But the US will also suffer, according to SBI, as India plays a crucial role in the global supply of affordable, high-quality essential medicines, particularly life-saving oncology drugs, antibiotics and chronic diseases treatments.

You may also like

Dozens of migrants face deportation after being caught working illegally in the UK

Coronation Street's Carla reels over Ryan's unexpected admission before Lisa proposal

Duvets will be cleaner without using your washing machine after 1 simple task in August

Peaky Blinders boss lifts lid on 'incredible' show revealing unseen side to Tommy Shelby

Clarkson's Farm star Harriet Cowan claims she is 'not making any money' despite show