Bengaluru-based neobank Fi Money is grappling with serious challenges as its core lending business has failed to gain traction leading to a cash crunch and mass layoffs.

Once seen as a promising digital banking player, Fi now faces a weakening runway, product cutbacks, and an uncertain future.

Multiple sources told Inc42 that Fi’s lending operations, once central to its revenue strategy, have been scaled back.

Despite claiming to have built its own NBFC infrastructure in a townhall in April 2024, Inc42 was unable to find any evidence of the company having an NBFC licence on the RBI portal. As per sources, the startup is still operating under a loan distribution model where it disburses loans on behalf of RBI-registered lenders. And scaling this up has become a challenge.

“At Fi Money, the past few quarters have been about making deliberate, strategic choices to strengthen our foundation and future,” cofounder and CEO Sujith Narayanan told Inc42.

He added: “As part of this process, we’ve phased out a few features that didn’t meet our benchmarks for engagement or monetisation. These decisions were rooted in data and user insights, reflecting our sharper focus on building a more sustainable and relevant product experience.”

Fi’s Big Burn And Shrinking RunwayBengaluru-based Fi Money is a neobank founded in 2019 by Sumit Gwalani and Sujith Narayanan, who was earlier part of the Google Pay team in India.

The company raised its seed round from Peak XV Partners, Ribbit Capital as well as CRED founder Kunal Shah. Alpha Wave and Temasek also invested in subsequent rounds as Fi raised more than $75 Mn in the first two years of its existence.

It targetted younger Indians in the early days as a go-to-market strategy, even as competitors like Jupiter and Open targeting small businesses. The core offering was a Federal Bank-backed bank account with an app to track spending, set up automatic savings schemes, make UPI payments, pay bills, and invest in Indian and US stocks, mutual funds.

Fi also introduced personal loans gradually and soon this became its core revenue stream. By 2023, Fi had over 3 Mn users, largely drawn in by its lending operations.

The Covid-19 lockdowns had accelerated adoption between 2020 and 2022 as demand for digital banking grew. The salary and income freeze across industries also led to a spike in demand for short-term personal loans during this period.

The likes of Fi capitalised in a big way by offering instant personal loans and other credit products.

According to sources, Fi spent heavily on user acquisition during this period, backed by high marketing spends. Notably, in FY23, the startup spent INR 132 Cr in marketing expenses.

However, the strategy attracted users with low lifetime customer value, especially given Fi Money’s target audience. Except for the lending business, the other financial services did not bring in returns, so Fi Money was compelled to continuously add new users which required heavy burn.

Today, the core banking product (launched in partnership with Federal Bank) remains active, but other services, including mutual funds, US stock investments, and rewards programmes, have now been scaled back. At least two more products are expected to be discontinued in the coming quarters, as per sources.

The company’s present strategy, according to insiders, is focussed on cost control and extending the runway. However, with reduced marketing, stagnant growth, and failed monetisation efforts, its future appears increasingly narrow.

Fi had once drawn users with big rewards and coin-based incentives. These have now been drastically reduced — limited to gift cards and minimum-balance interest payouts, leading to weaker engagement, especially among early adopters.

Downsizing Hurts Customer ExperienceInternally too, the company is facing turmoil. In the past three months alone, more than 50 employees were let go, with multiple exits per week in recent periods. This is a big chunk of the total workforce over the course of the past few months. According to multiple sources, Fi’s current workforce is less than 100 employees.

Data from Fi Money’s EPFO contributions corroborates the downsizing. As of April 2025, the company paid PF to 78 employees, which is almost half of what it paid in May 2024.

Sources tell us that staff cuts have taken a toll on product development. Some AI and automation initiatives have reportedly stalled due to lack of resources. Sources indicate that Fi Money had around 18 months of runway in December 2024, which dropped to 10 months by March 2025. No fresh capital has been secured since, and a new fundraise is not expected soon.

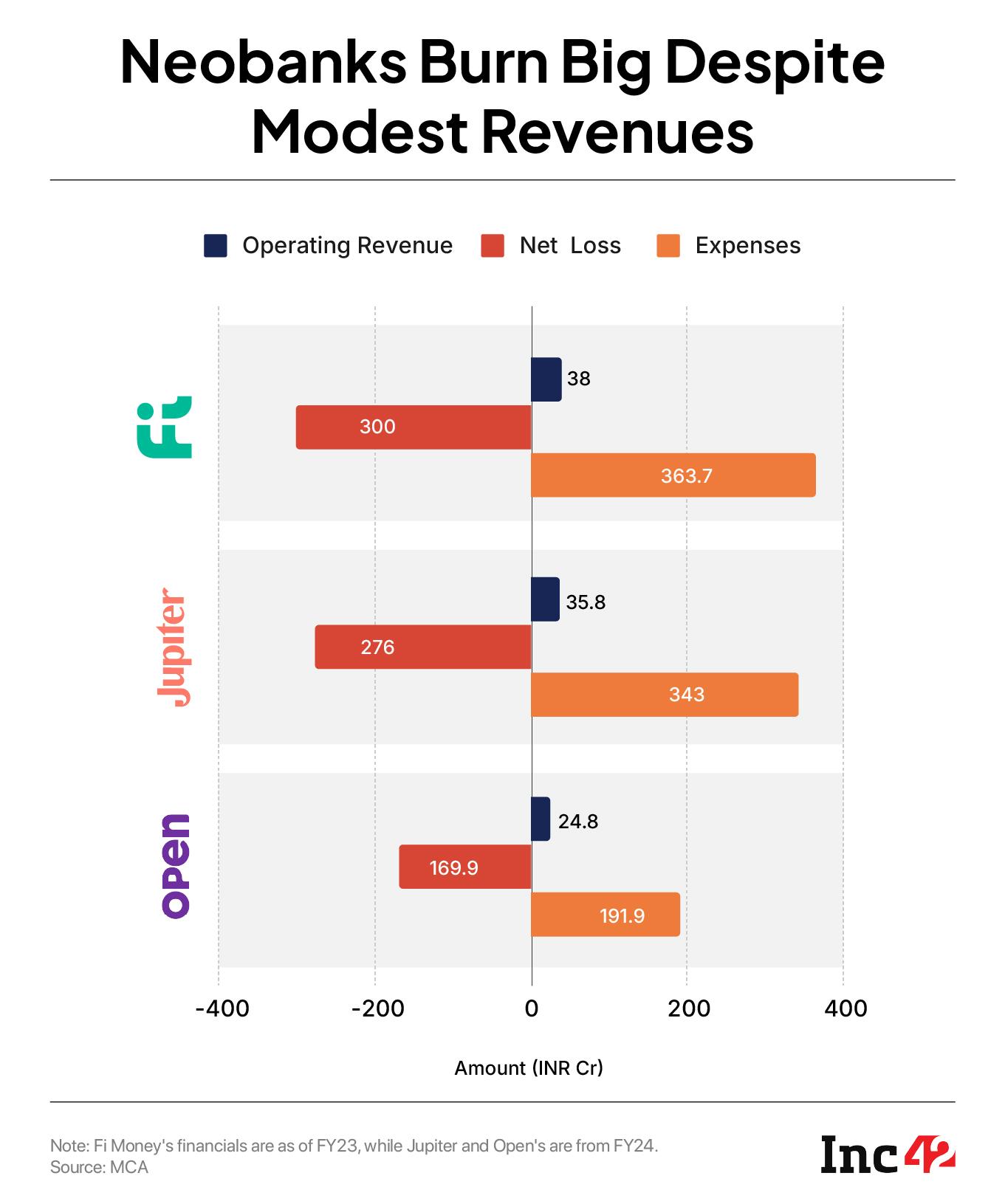

At a time when startups have started filing their financial year ending March 2025 (FY25) numbers with MCA, Fi is yet to share its FY24 numbers with the government. It had booked a net loss of INR 300 Cr on the operating revenue of INR 38 Cr in FY23.

These struggles have a cascading effect on customer satisfaction.

Some users report delayed refunds for cancelled transactions. One Reddit user, for instance, claims that Fi Money never completed the refund for a cancelled MacBook Pro order. Typically this could be solved with a chargeback, but Fi said the merchant was unresponsive to Federal Bank, leaving the user stuck in limbo.

Fi Money did not specifically respond to these allegations.

Customer support is another pain point and part of the reason is structural, since Fi isn’t a bank itself. As a neobank it has to partner with RBI registered banks — in this case, Federal Bank — for savings accounts and other banking services.

While Fi says users should contact them first and only escalate to Federal Bank after this step, customers have complained about the slow and frustrating support experience. Many users feel caught in a loop, with Fi and the bank pointing fingers at each other.

Compounding the issue, Fi’s services depend on multiple third parties. UPI services involve external providers. Card issues go through the bank, but must be reported to Fi. These added layers contribute to delays and confusion.

The other side of the problem is the RBI’s stricter rules for digital lending, which have hurt the operations of not just relatively smaller startups, but even the likes of Paytm. Digital lending apps from legacy banks such as SBI YONO and Kotak 811 also added to the competition for apps such as Fi Money.

Neobank Promise SoursAs we have reported in the past, neobanks such as Fi or even Jupiter, Open, Niyo and others cannot directly offer banking services. Having to rely on other banks is a double-edged sword as neobanks don’t have to do the regulatory heavy lifting but it also removes any sense of autonomy in operations .

It’s also pertinent to note that none of these neobanks are making a profit. Jupiter, for example, earned INR 35.8 Cr in FY24 on the net loss of INR 276 Cr. Similarly, Open earned INR 24.8 Cr on the net loss of INR 169.6 Cr.

Like Fi, both startups have raised a ton of money. Open famously became the 100th unicorn in India in 2023 and has raised over $250 Mn, while Jupiter has raised over $170 Mn. That’s not too far from Fi’s lifetime funding of $137 Mn.

The situation highlights the magnitude of the unit economics and scale problem for neobanks in India.

All in all, as of now Fi appears to be in consolidation mode, trying to hold ground and reassess its role in a cautious fintech landscape. The startup seems to be trying new ‘low cost’ features which also attracts users.

On these lines, the startup has launched a new AI feature which lets users ask personalised questions about their money from spending patterns to investment performance and receive real-time, AI-generated insights based on actual financial data.

At present, there are no signs of a push for customer acquisitions or product launches on the horizon. Lending may return as a focus, but only if the fundamentals improve.

If it ends up winding operations, Fi Money is unlikely to be the first neobank casualty in a market where there’s no differentiation among players due to the regulatory requirements.

Instead of neobanking, startups such as BharatPe and Slice have instead looked to bag small finance banking licences to take more control of their operations and live up to the revenue potential. Fi Money’s troubles do not bode well for the neobank brigade.

The post After Raising $137 Mn, Neobank Fi Money Battles Existential Crisis appeared first on Inc42 Media.

You may also like

4 of 7 microgravity tests done, Shubhanshu Shukla may undock on Tuesday

Beyond The Body: Human Struggle Between The Physical And Infinite

Chess: Understanding Rubinstein's 'Two Weaknesses' Strategy

WHO sends Sheikh Hasina's daughter on indefinite leave: Report

Iran always ready for talks on its nuclear program: FM Araghchi