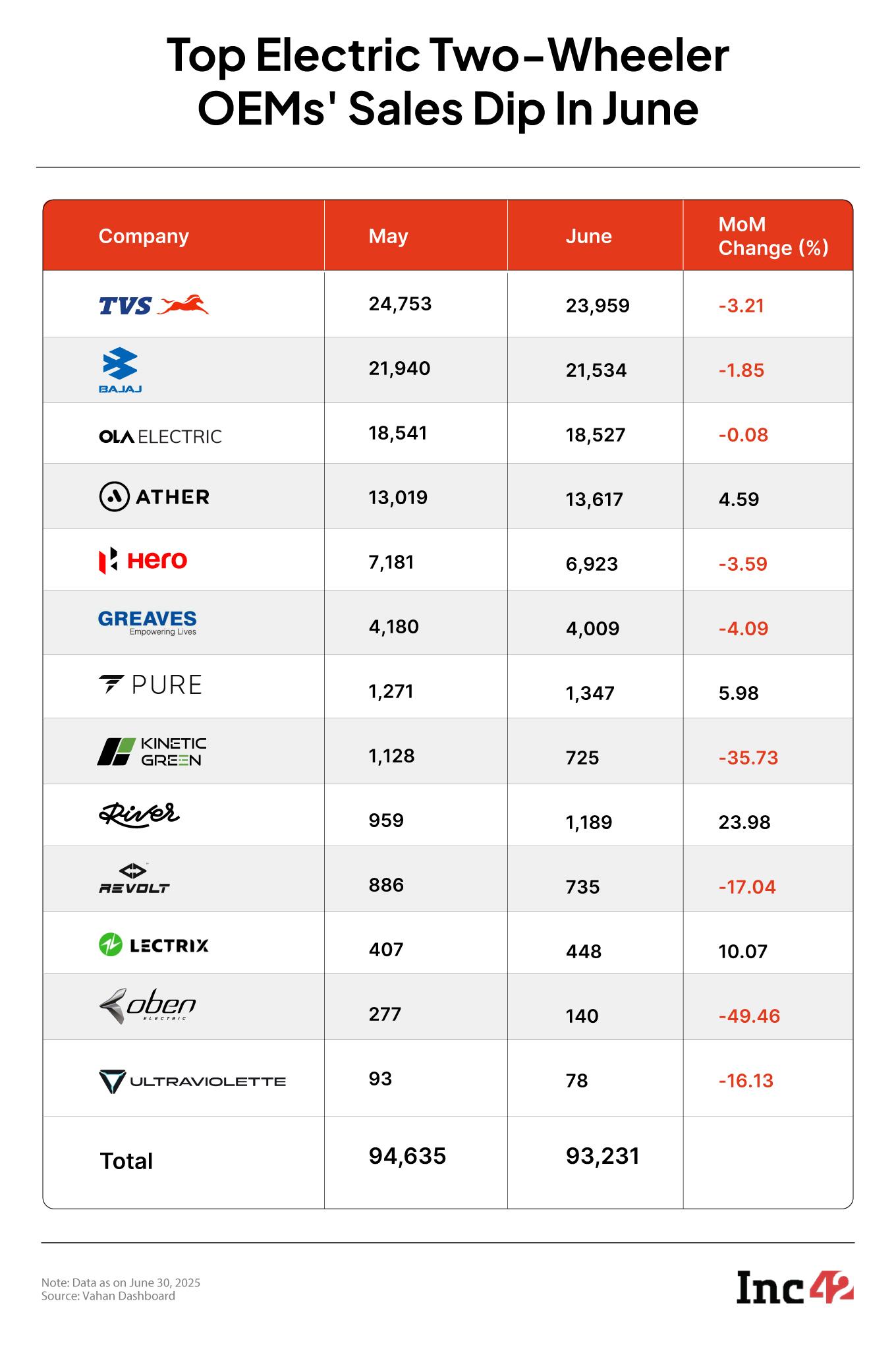

Automotive giants TVS Motor and Bajaj Auto continued to dominate the electric two-wheeler market in the month of June, as their monthly vehicle registrations remained above 20K despite a slight decline in sales.

Total EV sales in India saw around 7% decline in the month compared to May, which was reflected in the electric two-wheeler sales volume as well. Even as TVS Motor’s registrations fell around 3% month-on-month (MoM) and Bajaj saw a 2% decline, they remained ahead of Ola Electric and Ather Energy.

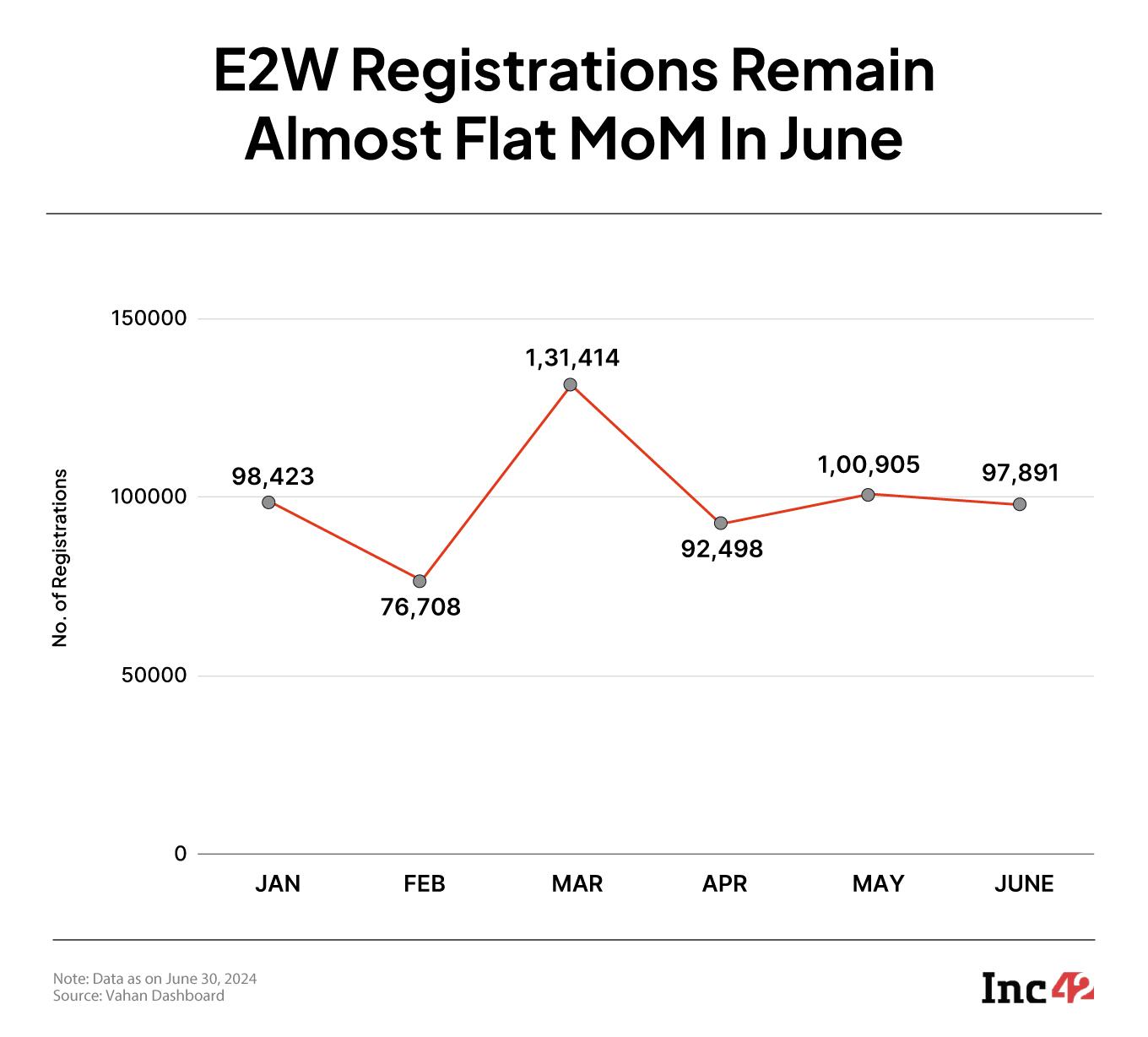

Bajaj sold 21,534 units of its Chetak escooters in June, while TVS’ registrations stood at 23,959 units. Total electric-wheeler registrations declined about 3% during the month to 97,891 units.

Meanwhile, the Bhavish Aggarwal-led electric two-wheeler maker, which has witnessed a sharp sales decline in recent months, saw 18,527 units of vehicle registrations in June, as per Vahan data as on June 30. This was almost flat compared to 18,541 registrations in May.

Notably, Ola Electric’s registrations remained flat despite it starting the deliveries of its first range of electric motorcycles, the Roadster X model, last month. On a year-on-year (YoY) basis, the company’s registrations declined almost 50% from 36,859 units it sold in June 2024.

The once EV leader now holds around 19% share in the electric two-wheeler market while TVS Motor and Bajaj hold over 24% and 22% market share, respectively.

Inc42 has reached out to Ola Electric for information on the total number of electric motorcycles sold during the month. The story will be updated on receiving a response from the company.

Who Defied The Broader Market Decline?Recently listed Ather Energy saw its registrations rise 4.5% MoM to 13,617 units in June. Even as the EV company witnessed some volatility in its sales volume in the past few months, in line with broader market trends, Ather’s registrations more than doubled from 6,216 units it sold in June last year.

In June 2024, the Hero MotoCorp-backed startup held a 7.7% share in the electric two-wheeler market, which has now increased to almost 14%. Its market share stood at 12.9% in the preceding month of May.

Overall, though the EV registrations saw a decline in June, experts believe this is not a matter of concern as there is inherent sluggishness in sales in the first quarter of every fiscal year. However, some see it as an impact of the rare earth ban by China, which was expected to cause some slowdown in the Indian EV market in the short to medium term.

Amid the volatility, Bengaluru-based EV startup River saw its registrations cross the 1,000 units mark for the first time in June, as per Vahan data.

River’s total registrations volume jumped almost 24% MoM to 1,189 units. The Yamaha Motor-backed startup said in a statement today that it rolled out its 10,000th Indie scooter in June, within 22 months of the first roll-out of the vehicle.

Pure EV, which is also gearing up for a public listing this year, saw about a 6% MoM rise in vehicle registrations to 1,347 units in June.

It is pertinent to note that after a sharp decline in sales volume last year following multiple incidents of vehicle malfunction and FAME-II policy changes, the company has been seeing a rise in volumes since December 2024. On a YoY basis, its sales volumes saw a 297% surge in June.

Earlier this year, the Hyderabad-based EV startup also signed a pact with Jio Platforms’ Jio Things Limited to integrate smart digital clusters and telematics into its EVs.

However, IPO-bound Greaves, Hero MotoCorp, electric motorcycle manufacturer Oben Electric, among others, saw a decline in registrations in June.

What’s Next For The EV Market?Experts continue to warn that the possible impact from rare earth ban would be visible in the sales volume coming months.

In its latest research report on Bajaj Auto, Kotak Institutional Equities said that production schedules and growth in its EV segment might face disruptions, as rare earth supply is expected to tighten from July. The company’s entire EV launch pipeline may face delays due to rare earth material supply issues in the two- and three-wheeler markets, the report said.

Hence, it goes without saying that the entire sector is expected to face the heat.

Meanwhile, Bengaluru-based electric motorcycle maker Ultraviolette’s recent global launch across 10 European countries marked an important milestone for the Indian EV industry this month. Experts believe that more automotive players need to start building a global playbook for their product and build accordingly.

Including all categories, EV registrations stood at 1.75 Lakh units in June, up more than 20% YoY.

Even as consolidation and failures continue in the sector, the year 2025 is expected to see the Indian EV market mature and learn to scale without subsidies. The companies in the sector will also have to find alternatives to rare earth elements. As per a report by Frost & Sullivan, total passenger EV sales are expected to rise to 1,38,606 units in 2025 from 99,004 last year.

The post EV 2-Wheeler Registrations: TVS, Bajaj Retain Top 2 Spots In June, Ather’s Market Share Grows appeared first on Inc42 Media.

You may also like

Shux, crew, study microalgae, cancer, cognition & more

Monster Hunter Wilds Title Update 2 patch notes - Can Capcom turn things around on Steam?

Happy to be his wingman, says Papa, Shux's backup astronaut

Jacqueline Jossa slams In The Style for 'not paying her for five figure deal'

15 dead & 35 injured as blast tears through chem plant near Hyderabad