MUMBAI/NEW DELHI:: After a knee-jerk reaction to US President Donald Trump's latest tantrums related to tariffs on Indian exports to the world's largest economy, late buying helped Dalal Street close slightly higher, indicating low impact of the tariffs' effects on domestic stocks and investments. After sliding over 700 points, sensex recovered all its lost ground in a late buying surge to close a marginal 79 points (0.1%) up at 80,623 points. On NSE, Nifty closed 22 points up at 24,596 points.

The turnaround happened on the back of some positive developments for the market. This included news about a possible meeting between Trump and Russian president Vladimir Putin later this month, and also Putin's expected India visit later in the year. PM Modi's expected visit to China later in Aug also added to the positive sentiment that triggered buying, market players said.

"Domestic equities recovered sharply from the intraday lows amid a volatile weekly expiry day. Although the earlier trade was weighed down by broad-based selling following steep US tariff hikes on India, sentiment improved towards the close as reports of potential peace talks involving Trump, Putin, and (Volodymyr) Zelenskyy (president of Ukraine) raised hopes of a softer US stance on trade," Vinod Nair of Geojit Investments said. "This renewed optimism triggered a strong rebound in the (stocks of) auto, pharma, metals, and energy sectors and aided the market in recalling its trajectory and concluding in the green."

Earlier in the session, brokers and fund managers said higher US tariffs could dent India's GDP by about 0.3-0.5 percentage points. However, govt support and the weakness of the rupee against the world's major currencies could cushion the impact.

"We estimate the overall cumulative impact of tariffs at 0.5-0.7% of India's GDP, with the sharpest effects likely in gems & jewellery, textiles, and mobile phones," said Trideep Bhattacharya, president & CIO-Equities, Edelweiss Mutual Fund. "This is the economic price India may have to pay to safeguard its domestic agricultural economy, as part of 'welfare motive' in our opinion. The broader consequence will be a mix of higher goods inflation, tighter producer margins, and a drag on global trade-a combination that could weigh on valuation multiples globally over time."

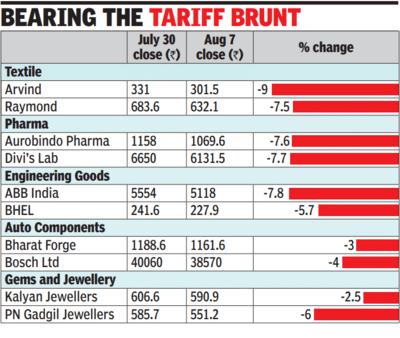

During the week, stocks of Indian export-linked companies took a sharp hit after the US hiked tariff rates. Textiles stocks experienced the sharpest setbacks, with Gokaldas Exports plunging nearly 19% since the announcement. Peers KPR Mill and Vardhman Textiles also posted double-digit losses. Engineering goods stocks also suffered, especially capital goods and turbine makers. Triveni Turbine slumped 14.7%, ABB India lost 8%, and others saw cyclical rise and fall. While pharmaceuticals remain exempt for now, stocks in the sector dropped 4-8% amid fears of future tariffs-especially after Trump threatened a 250% duty on drug imports.

The turnaround happened on the back of some positive developments for the market. This included news about a possible meeting between Trump and Russian president Vladimir Putin later this month, and also Putin's expected India visit later in the year. PM Modi's expected visit to China later in Aug also added to the positive sentiment that triggered buying, market players said.

"Domestic equities recovered sharply from the intraday lows amid a volatile weekly expiry day. Although the earlier trade was weighed down by broad-based selling following steep US tariff hikes on India, sentiment improved towards the close as reports of potential peace talks involving Trump, Putin, and (Volodymyr) Zelenskyy (president of Ukraine) raised hopes of a softer US stance on trade," Vinod Nair of Geojit Investments said. "This renewed optimism triggered a strong rebound in the (stocks of) auto, pharma, metals, and energy sectors and aided the market in recalling its trajectory and concluding in the green."

Earlier in the session, brokers and fund managers said higher US tariffs could dent India's GDP by about 0.3-0.5 percentage points. However, govt support and the weakness of the rupee against the world's major currencies could cushion the impact.

"We estimate the overall cumulative impact of tariffs at 0.5-0.7% of India's GDP, with the sharpest effects likely in gems & jewellery, textiles, and mobile phones," said Trideep Bhattacharya, president & CIO-Equities, Edelweiss Mutual Fund. "This is the economic price India may have to pay to safeguard its domestic agricultural economy, as part of 'welfare motive' in our opinion. The broader consequence will be a mix of higher goods inflation, tighter producer margins, and a drag on global trade-a combination that could weigh on valuation multiples globally over time."

During the week, stocks of Indian export-linked companies took a sharp hit after the US hiked tariff rates. Textiles stocks experienced the sharpest setbacks, with Gokaldas Exports plunging nearly 19% since the announcement. Peers KPR Mill and Vardhman Textiles also posted double-digit losses. Engineering goods stocks also suffered, especially capital goods and turbine makers. Triveni Turbine slumped 14.7%, ABB India lost 8%, and others saw cyclical rise and fall. While pharmaceuticals remain exempt for now, stocks in the sector dropped 4-8% amid fears of future tariffs-especially after Trump threatened a 250% duty on drug imports.

You may also like

Silver Shines Bright: Prices May Hit ₹1.21 Lakh/Kg by August-End—Here's What's Driving the Surge

Freaky Friday fans are just learning Jamie Lee Curtis almost wasn't in original film

SC Recalls Its Own Order To De-Roster Allahabad HC Judge

Microsoft: Windows 10 support is about to end, now you will have to buy a plan for security updates..

FD vs RD: Where Should You Invest ₹7 Lakh for 5 Years to Get Better Returns?